Research

9 min read

Monad Mainnet: The First 50 Days

An Early Post-Launch Assessment

Published on

January 19, 2026

Introduction: The Post-Hype Reality

It has been just over 50 days since Monad’s mainnet went live. The network has now moved past its launch phase, which was characterized by heightened speculation, incentive-driven activity, and short-term user behavior. The airdrop farming that dominated the first week has largely faded, creating a clearer environment in which real usage patterns can be observed.

This period is critical in the lifecycle of any Layer-1 blockchain. Many networks struggle to retain meaningful activity once incentives subside and attention shifts elsewhere. User engagement often drops sharply, liquidity thins out, and early stress tests give way to slower, more routine usage. A common industry view is that most new chains fail to sustain momentum beyond their first few months.

Monad appears to be entering a different phase. Rather than chasing continued hype, the network is showing early signs of stabilization.

Monad launched on November 24 with a fixed supply of 100 billion MON and an initial public sale conducted via Coinbase’s Token Platform. In the weeks following launch, the network settled into a more representative operational baseline. With the early noise behind it, it becomes easier to assess what the chain is demonstrating in practice. This includes early adoption patterns, performance under real usage, and whether its architectural choices are translating into measurable outcomes.

This assessment is especially relevant given Monad’s extended development timeline. The protocol was built over roughly three and a half years, with close to the first year focused on research, tooling, and prototyping. That preparation phase shaped several clear design goals:

- A consistent block time of roughly 400 milliseconds

- Single-slot finality at around 800 milliseconds

- Higher throughput through parallel execution

- Predictable performance under load

In this research note, we evaluate Monad through two post-launch lenses that matter most once incentives normalize:

-

Observable network metrics that allow promised performance to be compared with reality

-

The emerging application ecosystem, with a focus on TVL composition and capital behavior

The goal is not to forecast long-term outcomes, but to document what can be measured at this stage.

Metrics and Promises: Performance in Practice

Block Time and Finality

One of Monad’s most closely watched claims prior to launch was its target block time of approximately 400 milliseconds. In high-performance networks, consistency matters more than peak speed. Fast block times lose value if they fluctuate under load.

Finality has also remained consistent. Median confirmation times cluster around the targeted 800 millisecond range, with occasional spikes that do not materially affect application behavior. For developers and users alike, this combination of predictable block production and sub-second finality materially improves the usability of the chain.

From a technical standpoint, Monad’s consensus layer is behaving as designed under real conditions.

At launch, Monad saw daily transaction counts peak at approximately 4.2 million. Over the following weeks, this figure gradually normalized to a range between 1.5 million and 2 million transactions per day.

This pattern is familiar. Launch-phase transaction spikes are typically driven by incentive-seeking behavior, including wallet churn, scripted interactions, and low-value transactions designed to maximize airdrop eligibility. As incentives fade, that noise clears.

Viewed in context, a sustained baseline of over 1.5 million daily transactions 50 days after launch suggests retention rather than decay. It indicates that a core set of users and applications continue to find the network useful without immediate rewards.

This transition from speculative activity to utility-driven usage is an expected, and healthy, phase in a network’s lifecycle.

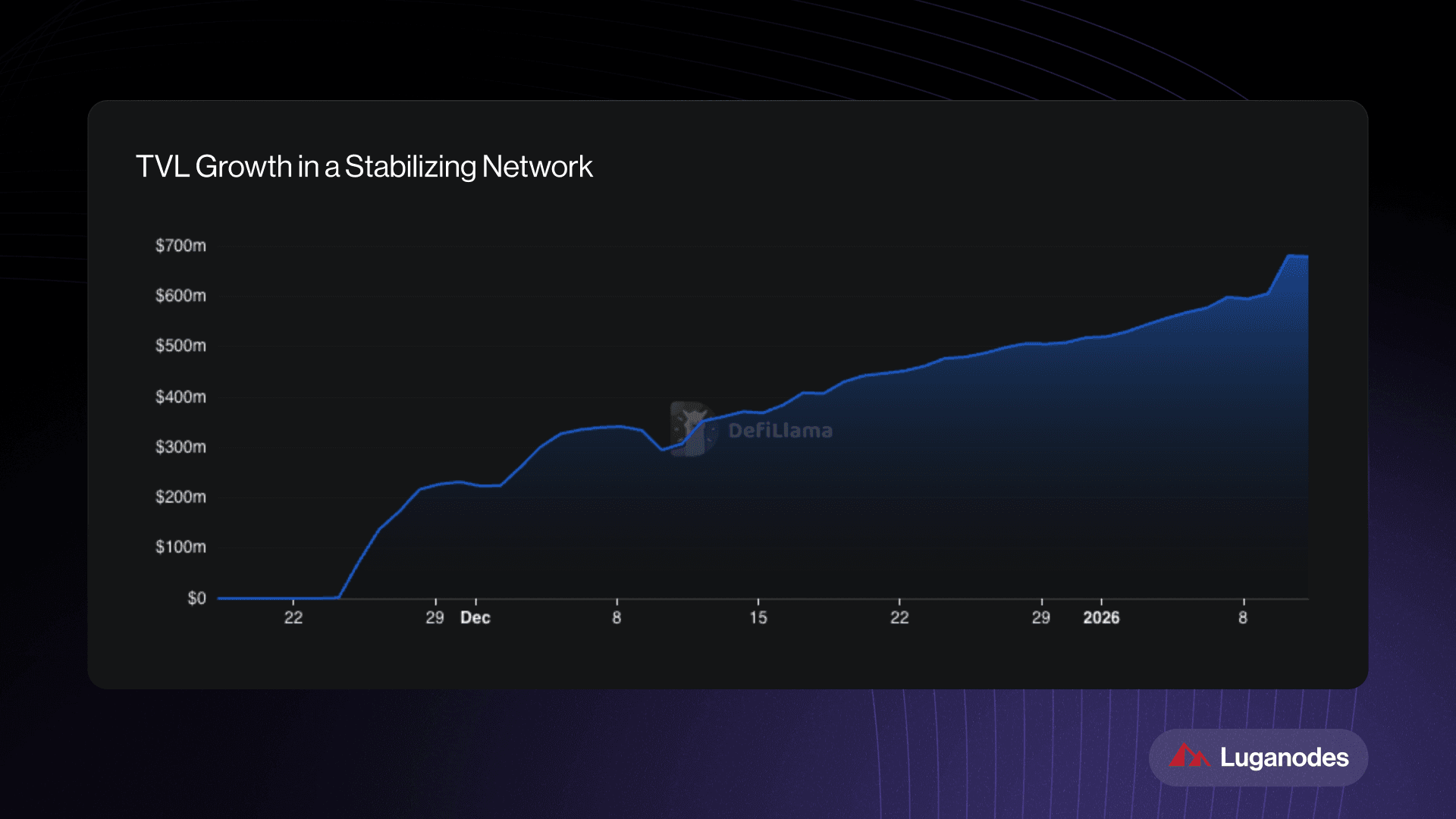

TVL Growth in a Stabilizing Network

One of the more notable post-launch dynamics on Monad is the divergence between transaction volume and total value locked.

While daily transaction counts declined as the network stabilized, TVL continued to rise and has reached an all-time high of $678.6m. This pattern differs from many newer networks, where TVL often peaks early and erodes once incentives unwind.

Lower transaction counts paired with rising TVL suggest a shift in participant composition. Activity is increasingly driven by capital-intensive users who interact less frequently but deploy larger amounts of capital. This includes funds, DAOs, and sophisticated DeFi participants.

DeFi Composition: A Lending-Led Stack

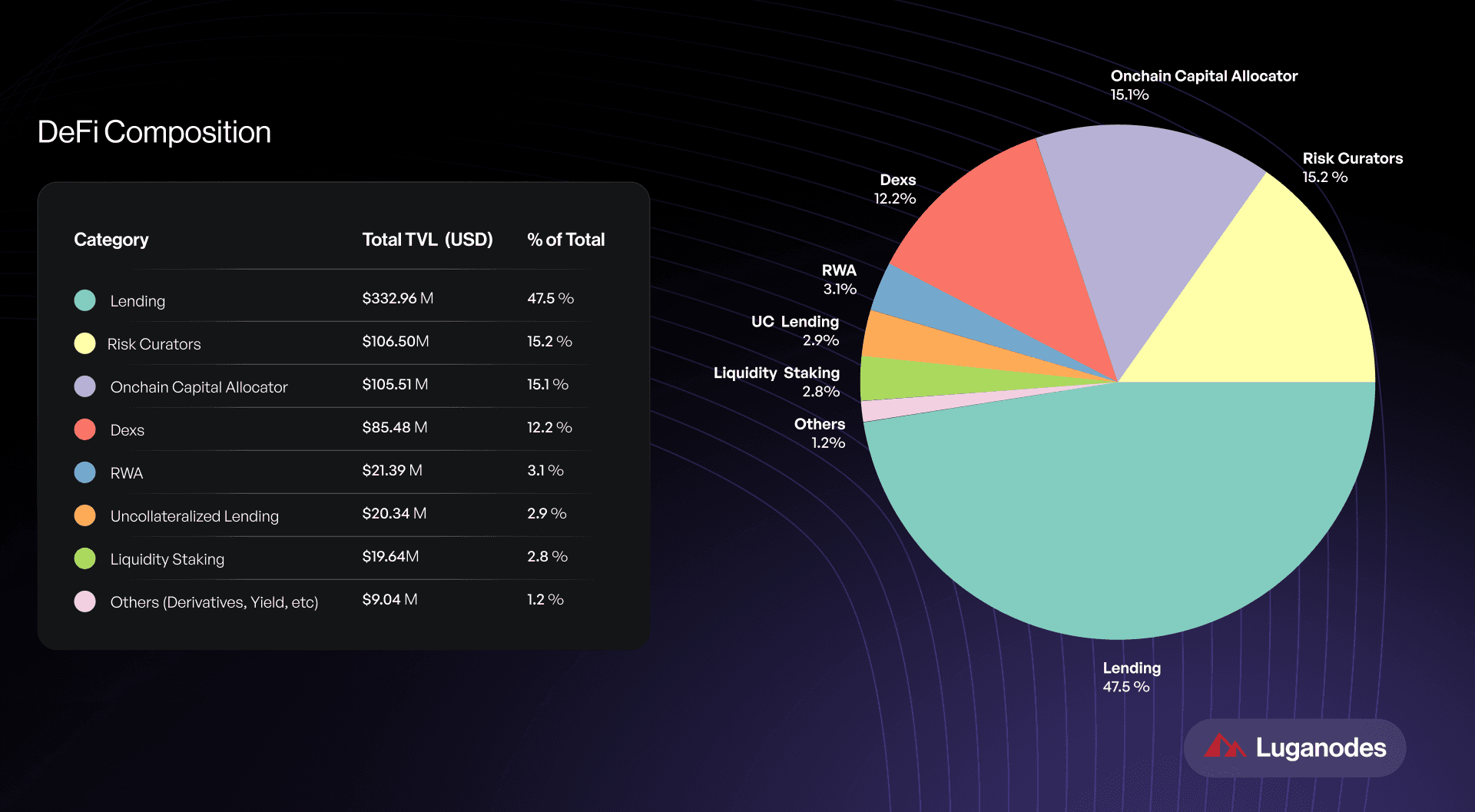

A closer look at TVL distribution provides further clarity. Monad’s DeFi ecosystem is clearly lending-led and capital-efficient, with the following breakdown:

Lending protocols such as Morpho and Curvance anchor the ecosystem, reflecting strong demand for capital efficiency and yield-focused primitives. This segment alone accounts for nearly half of all capital on the network.

Risk Curators and Onchain Capital Allocators together account for 30.3% of TVL. Protocols like Upshift, alongside risk managers such as Steakhouse Financial, form a meaningful institutional layer. Their presence suggests a more mature capital stack than is typical for a network at this stage.

Decentralized exchanges remain critical infrastructure, with Uniswap leading in liquidity. It is worth noting that much of Monad’s trading activity flows through aggregators such as Matcha and OKX, which route orders to underlying DEX liquidity pools. This pattern, where aggregators capture user-facing volume while DEXs provide backend liquidity, reflects a maturing trading stack and mirrors usage patterns on Ethereum mainnet.

Overall, Monad’s TVL composition looks less like a speculative launch ecosystem and more like a compressed version of Ethereum’s DeFi stack.

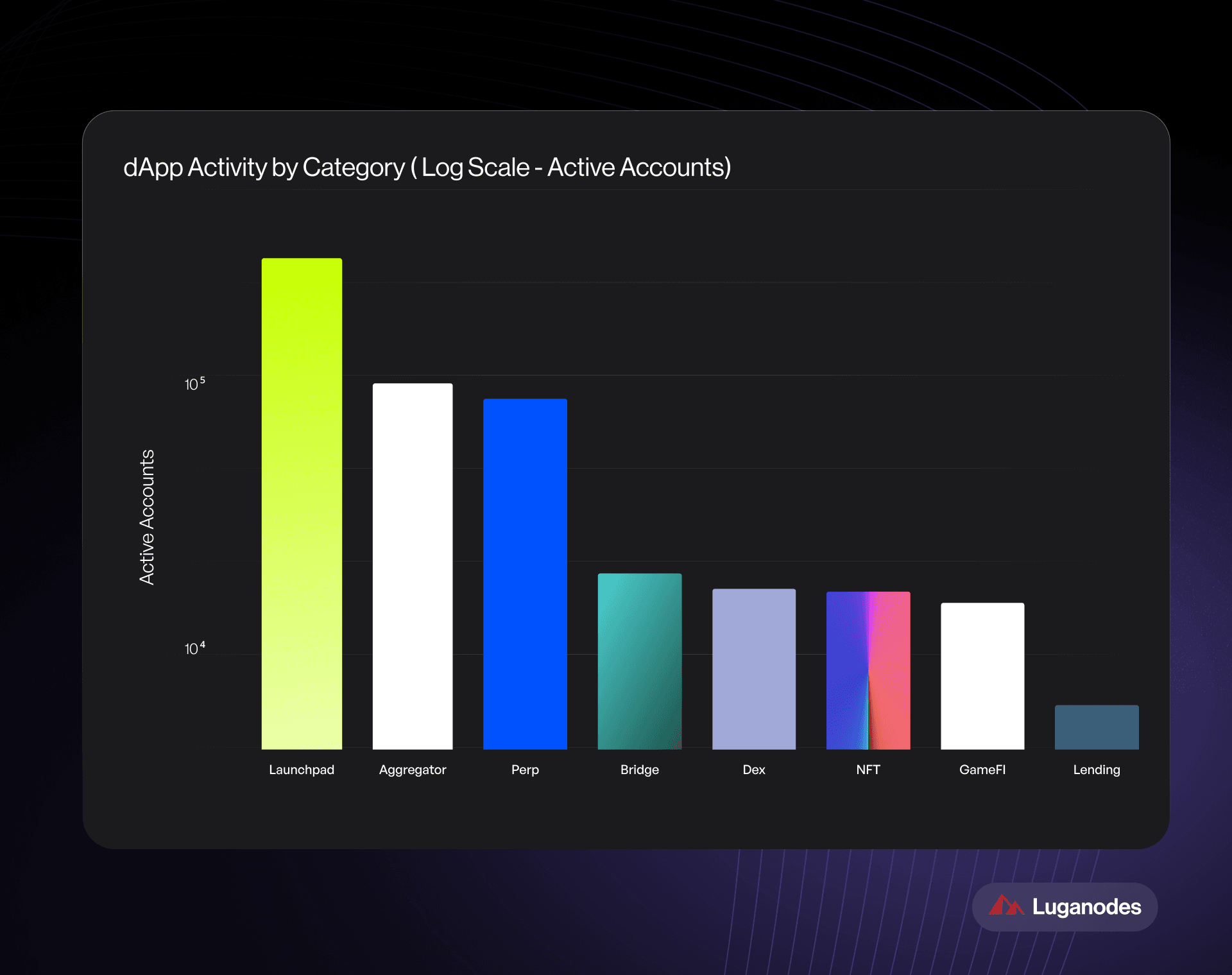

A more granular view of usage patterns of top 100 dApps, reveals a bifurcated ecosystem.

On one side sits an institutional core. This layer is defined by large pools of capital concentrated among relatively few addresses. Morpho, with approximately $136m in TVL, and Upshift, with roughly $101m, anchor this segment. Despite their size, these protocols maintain modest active account counts, reflecting institutional behavior focused on capital efficiency rather than frequent interaction.

On the other side is a retail-driven activity layer. Here, transaction volume is high, but capital deployment is light. Nad.fun exemplifies this dynamic, with nearly 500,000 accounts and close to one million transactions, despite holding less than $100k in TVL.

Kuru Exchange further highlights this pattern. Roughly 4,000 users have generated more than 4.4 million transactions, averaging over 1,100 interactions per user. This high frequency reflects Kuru’s architecture as an onchain order book exchange, where market makers continuously place and cancel orders. This is a use case that benefits directly from Monad’s low-latency execution.

While both layers function effectively on their own, the gap between them remains notable. Capital depth and user velocity are currently decoupled. Bridging these two usage patterns represents both a challenge and an opportunity for future development. Protocols that can translate high retail engagement into deeper capital deployment may define the next phase of the ecosystem.

EVM Compatibility in Practice

A central pillar of Monad’s strategy has been full EVM bytecode equivalence. This allows Ethereum smart contracts to deploy without modification.

In practice, this has worked as intended. Major Ethereum protocols such as Uniswap, Morpho, Curve, and Euler deployed quickly, often within days, using familiar tooling.

As a result, approximately 90% of early liquidity originates from ported Ethereum blue-chips. Rather than building a DeFi stack from scratch, Monad imported a mature one, immediately raising the baseline security and credibility of the network.

This approach has positioned Monad less as an experimental Layer-1 and more as a performance-optimized extension of the Ethereum application layer.

Conclusion: An Early Assessment

Nearly two months into mainnet, Monad is showing strong early promise.

The network has maintained a consistent 400 millisecond block time, achieved sub-second finality, and grown TVL even as speculative transaction volume normalized. These are meaningful outcomes during one of the most fragile phases of a blockchain’s lifecycle.

Several open questions remain as the network matures. Can the retail activity layer be channeled into deeper capital deployment? Will liquid staking, currently representing less than 3% of TVL, unlock the next phase of growth? And most critically, can Monad maintain its performance characteristics as state size grows and usage intensifies? The answers will define whether this early momentum translates into sustained ecosystem development.

For now, Monad presents a clear picture. The ecosystem is institutionally anchored, capital-efficient, and supported by credible technical performance. While still early, the foundational promises around speed, compatibility, and usability are largely being met in practice.

The coming months will determine whether these early signals harden into long-term network effects.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.