Update

6 min read

Luganodes Terminal: Unlocking Insights

Discover our state-of-the-art portfolio tracker!

Published on

November 5, 2023

Enterprises, including venture capital firms, hedge funds, and banks, navigate the complex landscape of substantial investments. To fortify risk mitigation strategies, Luganodes introduces the Terminal—a sophisticated staking platform designed to provide centralized insights into portfolio performance.

Crafted with precision, the Terminal consolidates actionable insights for both institutions and retail investors, offering a unified perspective on their delegations. This capability is driven by Luganodes' proprietary in-house indexers, meticulously tailored for each blockchain. These custom indexers empower institutional clients with precise access to historical on-chain data, elevating their decision-making processes.

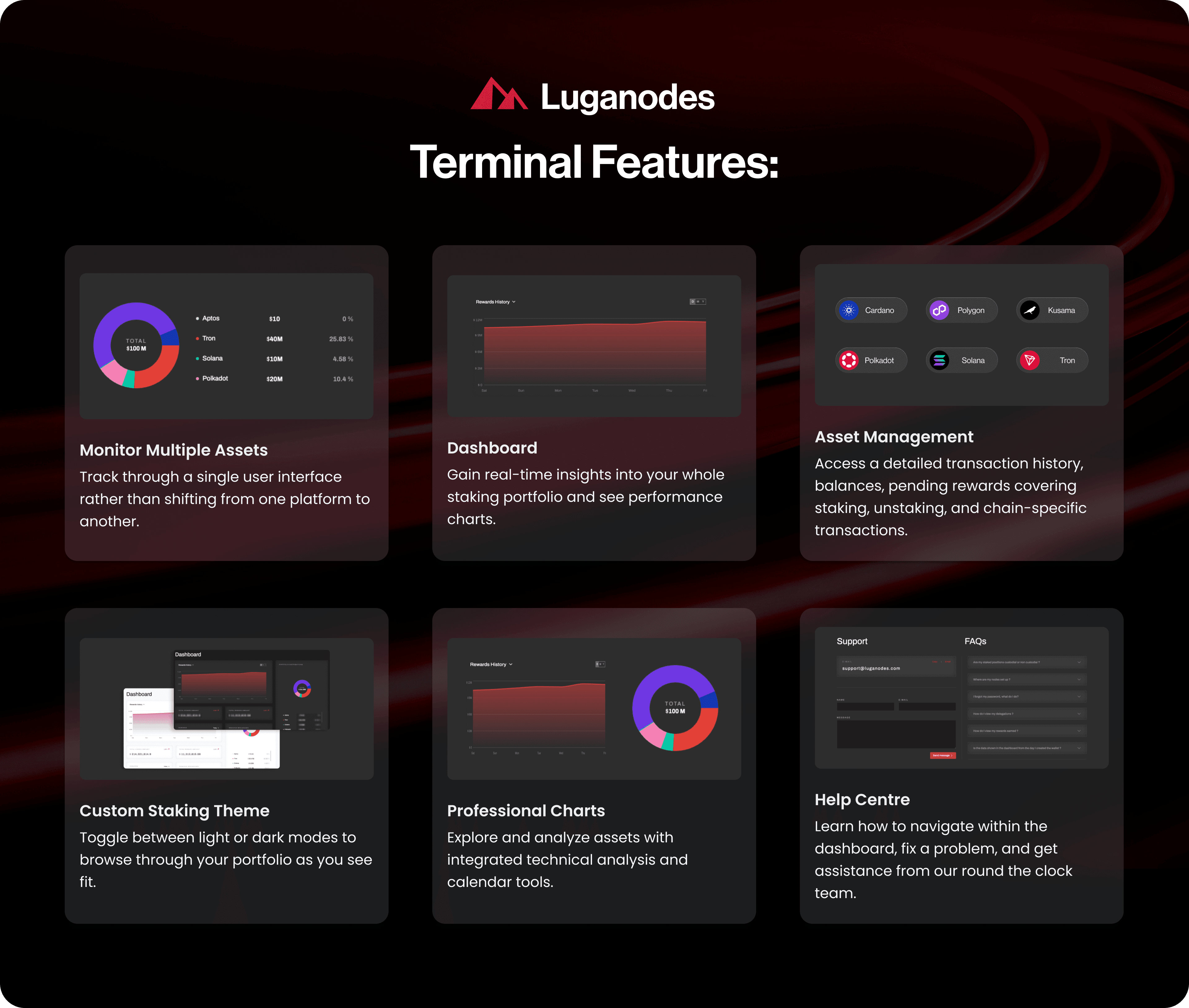

Comprehensive Support for Networks

The Terminal's robust indexers extend comprehensive support across a diverse range of blockchains. This ensures a broad spectrum of coverage for institutional clients, enhancing their ability to navigate the intricacies of blockchain investments. Currently, the Terminal indexers provide support for the following chains:

With the ability to add and keep track of multiple wallets, as well as monitor rewards and delegation, our indexers empower institutions with detailed insights and efficient management across these dynamic networks.

Getting Started

Learn how you can get started with the Luganodes Terminal in 2 simple steps!

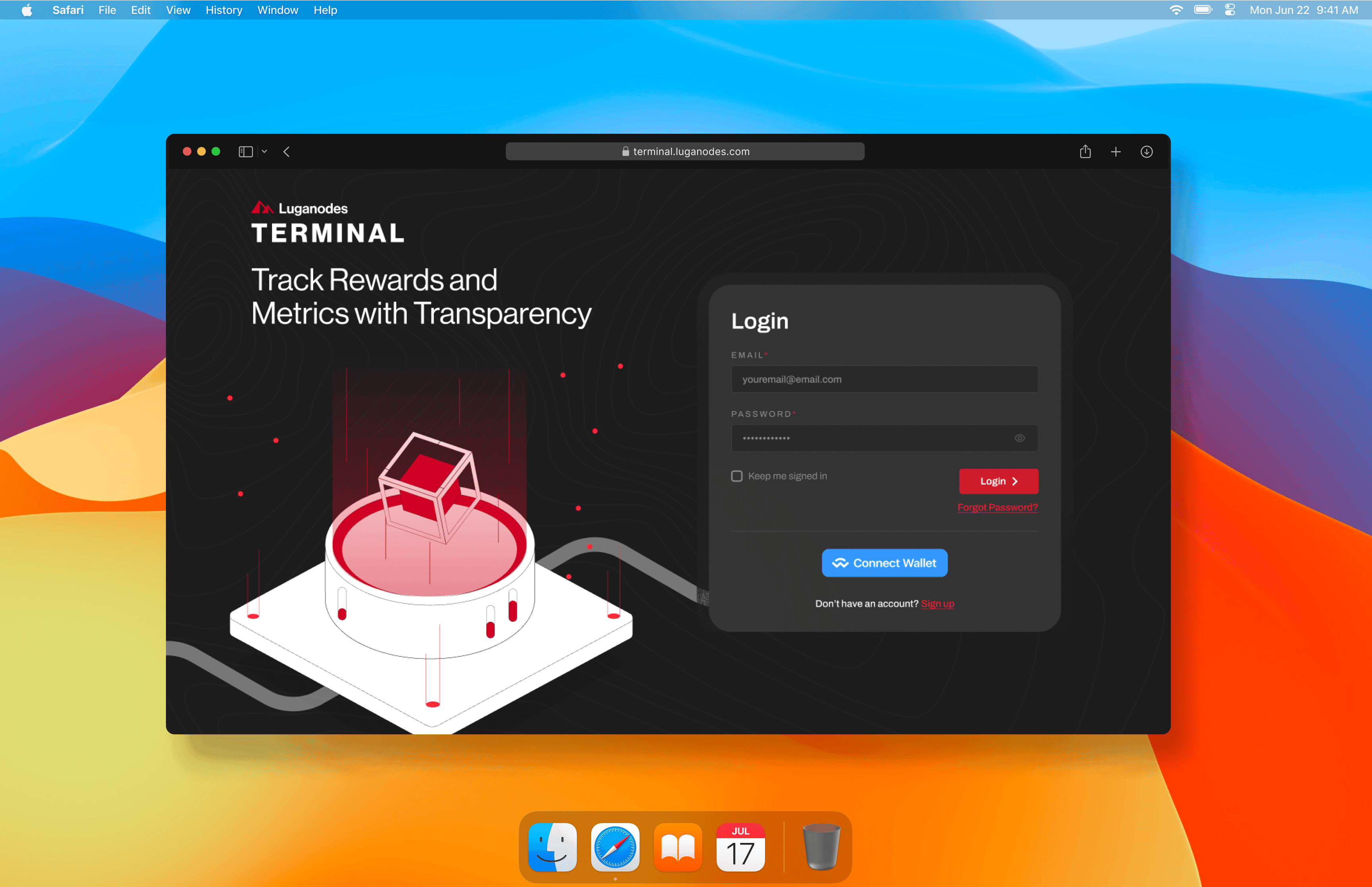

Create an Account

To embark on your Terminal experience, the first crucial step is creating an account. Choose between the traditional email registration or the streamlined Wallet Connect option, tailored to your preference.

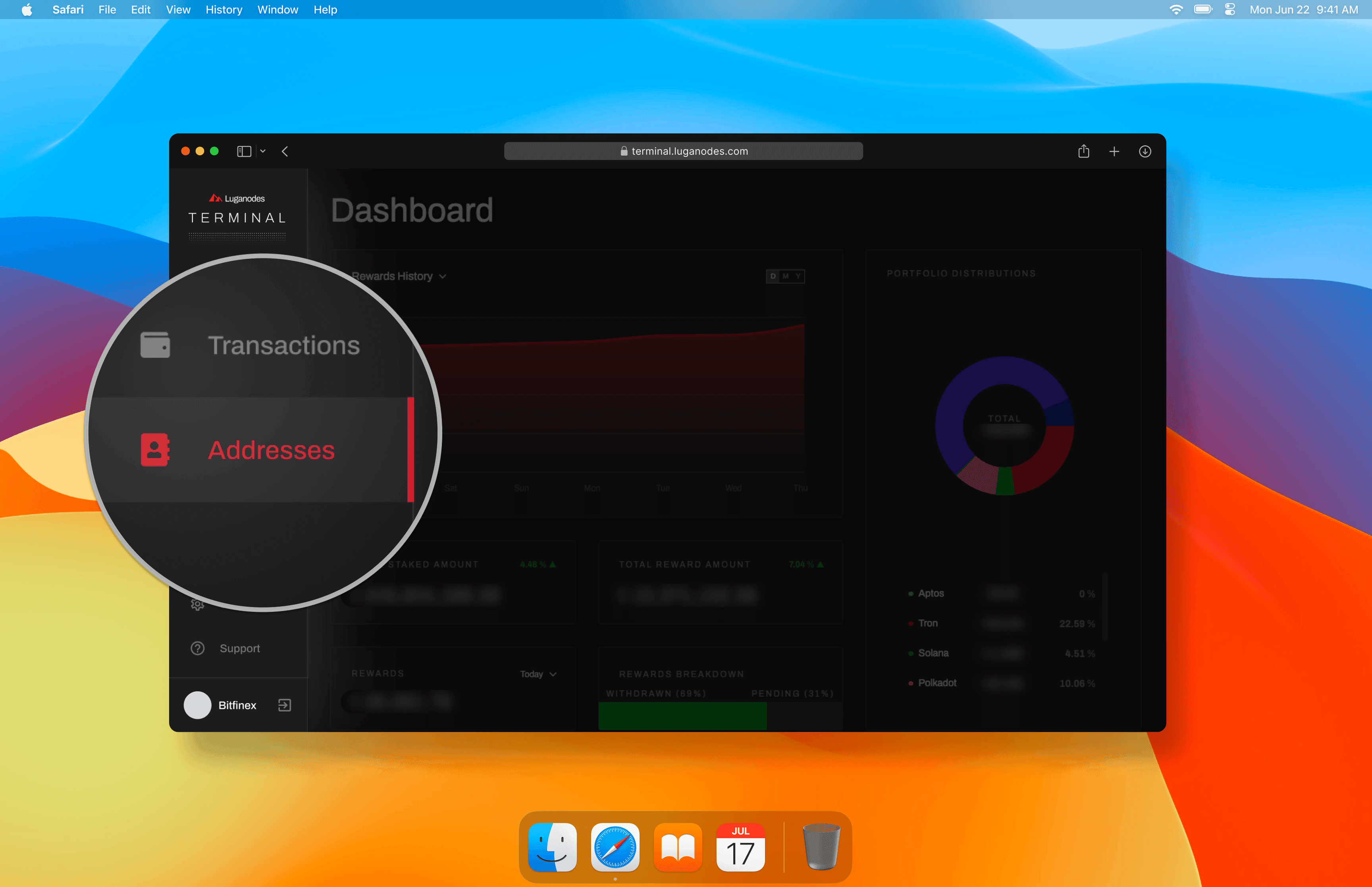

Add your Addresses

After successfully registering and signing in, the address section facilitates the addition of addresses linked to token delegation to Luganodes. Our customers can harness the platform's unparalleled adaptability, enabling the inclusion of multiple addresses, with each earmarked for a specific chain. Feel free to add or remove addresses as per your preference.

Ⓘ If your stake with Luganodes is still awaiting activation, the Terminal temporarily restricts address additions. Our meticulous indexers may take a few hours to process and index addresses from users who have recently staked their tokens.

Features

Luganodes Terminal, equipped with tailored custom indexers for each chain, grants users precise access to on-chain data. Our mission is to furnish users with actionable insights into portfolio performance. To achieve this, the Terminal is loaded with features for an intuitive client experience. The following features facilitate a consolidated view of staking statistics, portfolio distribution, network statistics, and reward metrics—all presented through a sleek user interface.

Dashboard

Monitor your Key Metrics

The Terminal offers users a comprehensive overview of their portfolio, leveraging our in-house custom indexers to provide valuable insights. We monitor the following key metrics:

-

Total Staked Amount across all chains

-

Total Rewards Earned across all chains

-

Yearly, monthly, and current rewards across all chains

-

Interactive widget displaying withdrawals and pending rewards

-

Portfolio distribution illustrated through an interactive pie chart

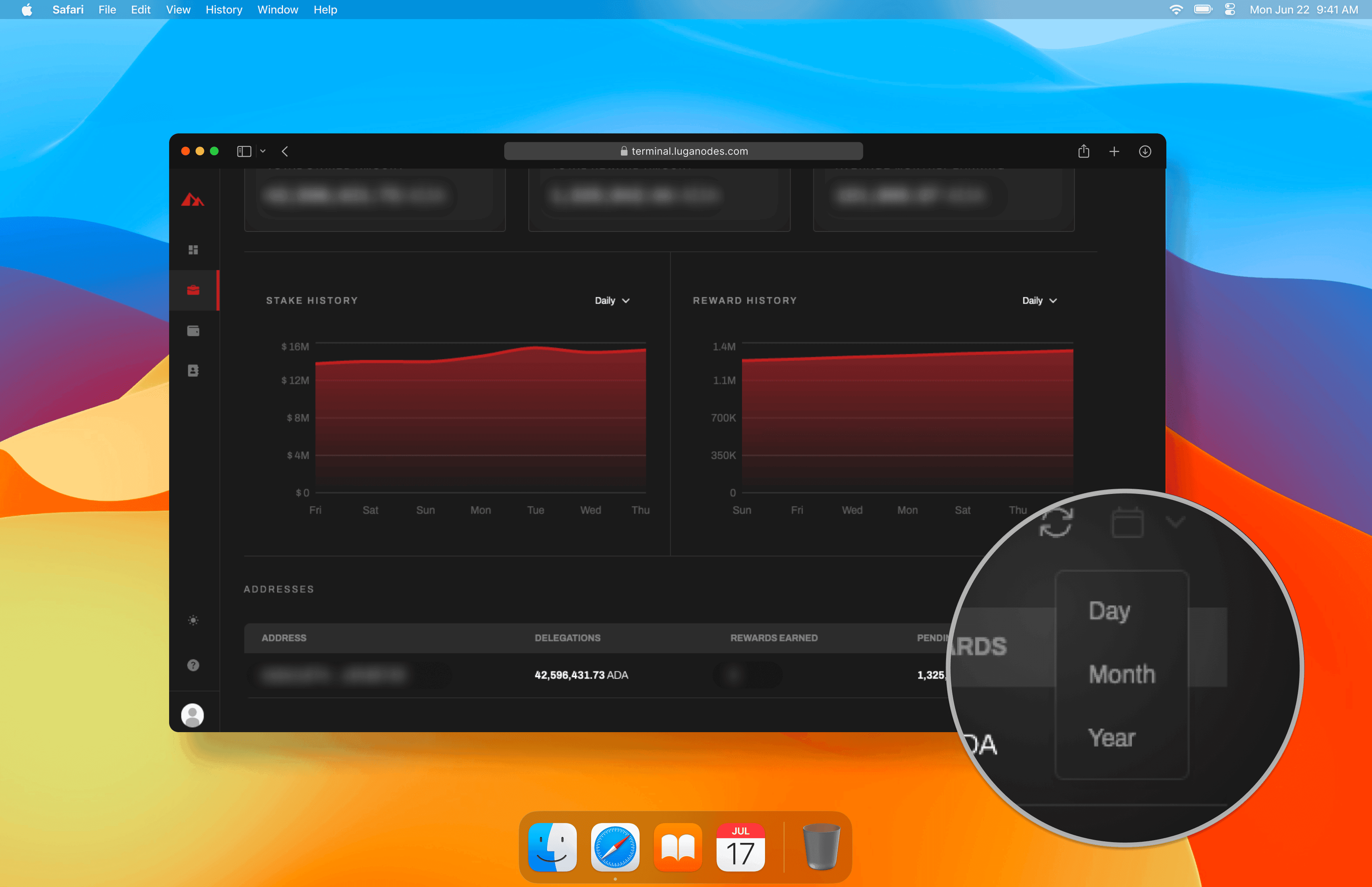

In addition to these metrics, users can delve into their reward and stake history via dedicated graphs.

Ⓘ The reward and stake history graphs present a historical perspective, accounting for fluctuations in token prices and reward tokens since the initial stake date.

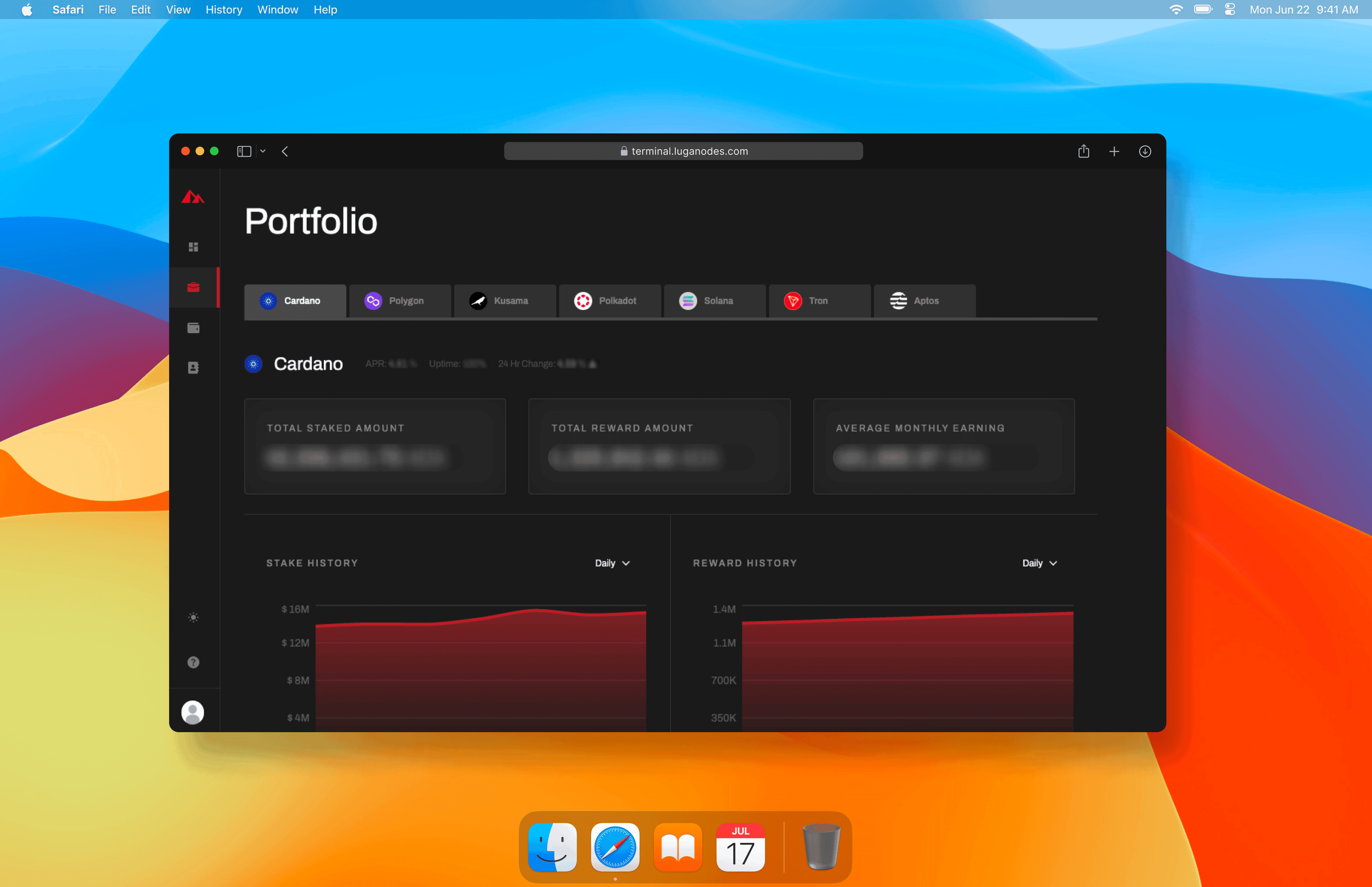

Portfolio

Portfolio Insights

The portfolio page empowers users to examine reward metrics at a chain level. Users gain visibility into average monthly rewards, total rewards, and pending rewards. Granular access to staking and reward history is facilitated through filterable graphs, offering insights that can be customized by day, month, and year.

Delegation Details at a Glance

The address table provides users with delegation data at an address level. Users can leverage a date filter to access granular information, such as rewards earned on a specific date, month, or year. This feature offers a comprehensive view of delegation details for informed decision-making.

Transactions

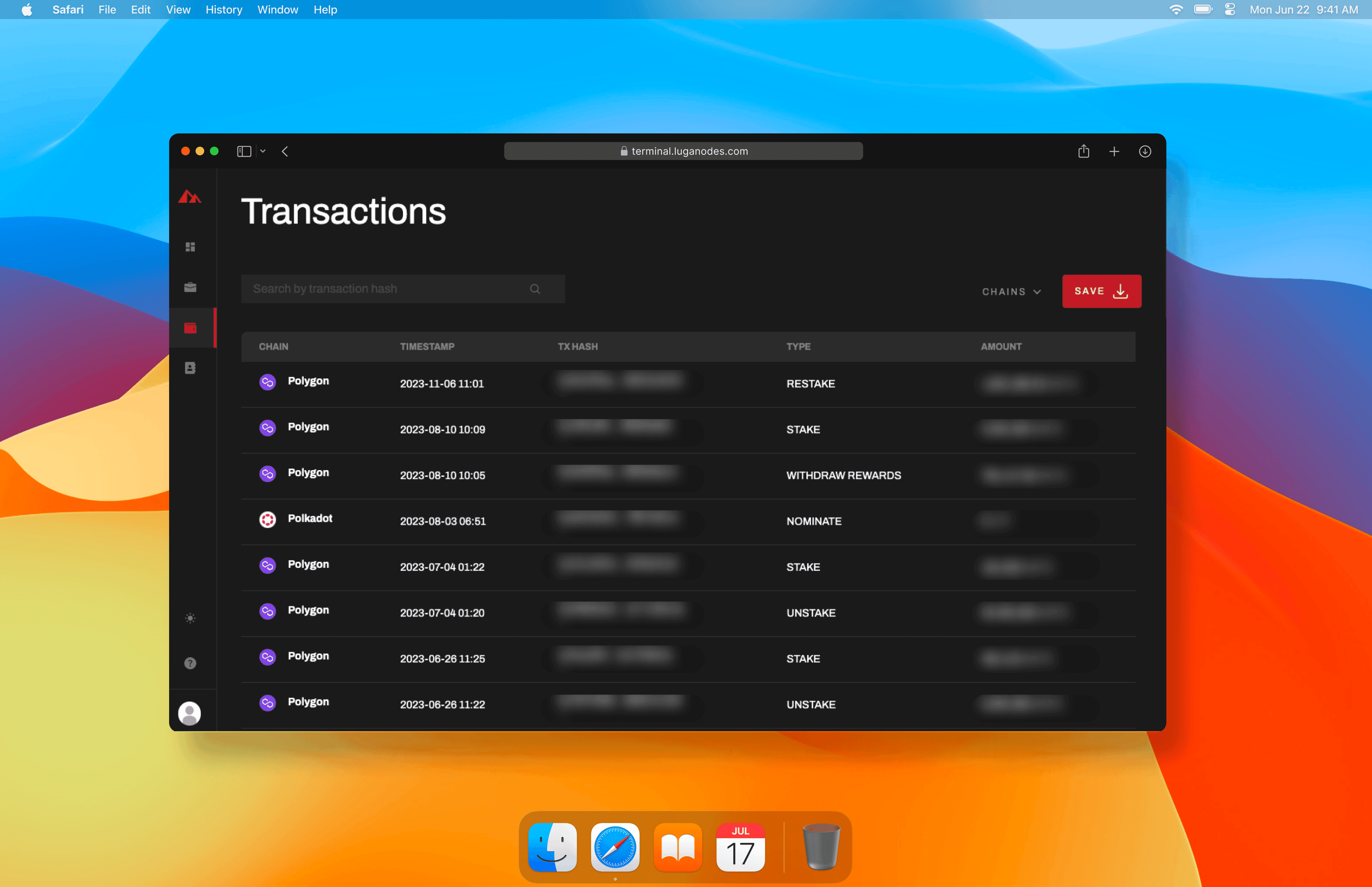

Transaction Tracking

Through the Terminal, users can monitor all staking-related transactions, including reward payouts. While these transactions may vary at a chain level, with some reward payouts not displayed as transactions. Additionally, users have the ability to download chain specific transaction reports which cover all transactions from the day of stake.

✓ Luganodes does not track all wallet transactions. Tracked addresses include ones which interact with Luganodes staking contracts on all chains.

Exporting Transactions

In the Terminal, users have the convenient option to export transactions to an Excel sheet, serving as a valuable tool for tax purposes. The exported report includes the following parameters:

-

Transaction Hash: Hash of the transaction on the block explorer.

-

Transaction Type: Encompassing all staking transactions, including stake, unstake, auto-compounding, and reward payouts.

-

Amount: Number of tokens associated with the transaction.

-

Timestamp: Timestamp of the transaction.

For your reference, a sample transaction is available for download here.

Conclusion

Luganodes' Terminal is a powerful platform that offers comprehensive support for blockchain investments. It provides precise insights and a user-friendly experience for institutions, with features such as portfolio monitoring, transaction tracking, and the ability to export transaction data for tax purposes. This all-in-one solution streamlines the management of blockchain investments for enterprises and financial institutions.

To learn more about our active networks, check out our documentation.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.