6 min read

An Overview: The Avalanche Ecosystem

Unlocking the Potential of Web3 with Avalanche

- Fast finality and fast transaction processing time through a novel consensus mechanism

- ~ 4500 transactions per second

- Everyone can become a validator on staking 2,000 AVAX

- No slashing of stakes

- Easy migration of Ethereum-based projects

Introduction:

Launched by Ava Labs in 2020, Avalanche has quickly established itself as one of the most promising Layer-1 blockchains in the web3 space. The idea for Avalanche was conceived with an aim to address the issues which have long plagued many blockchains like Ethereum; low transactions per second (TPS), slow finality, and congestion caused by scaling. Avalanche has centered its design around the goals of scalability, speed, and security. This revolutionary smart contracts platform is ushering in the next generation of blockchains by the virtue of its low fees and the ability to process thousands of transactions per second. It allows exploration in numerous use cases, everything from decentralized finance (Defi) and NFTs to enterprise partnerships. Solidity support is provided out of the box, hence offering a smooth transition for Ethereum developers.

Avalanche stands out among other upcoming layer-1 networks owing to its novel approach to achieving consensus. With the consensus conversation being highly centered around proof of stake (PoS) and proof of work (PoW), a false notion of blockchains being sluggish and unscalable has percolated among their users. Another area where many projects compromise is the number of validators in the network, leading to centralization as these few nodes must be trusted. Avalanche can operate with no known upper bound of participants in the network. At the time of writing this article, the validator count of Avalanche is ~1200. Built on top of the PoS approach, the Avalanche protocol for consensus achieves safety guarantees, quick finality, and high throughput without compromising decentralization.

A validator node receives a transaction initiated by any of the users in the network. This validator node queries a small, random subset of validators whether they think the transaction should be accepted or rejected. The validators essentially indulge in “gossiping” with each other. After the confidence threshold is reached, the decision on the transaction is locked in as final. This process is called “repeated random sampling”. These mechanisms correspond to sub-second transaction times (~ 4500 TPS) on Avalanche, which is only a tad shy of matching performance with top-tier payment processors like PayPal and VISA.

Avalanche nodes are eco-friendly and exceptionally economical. Avalanche nodes are CPU-bound and offer high throughput. Meaning, the network doesn’t necessitate the use of specialized hardware to accomplish a high number of transactions per second. Chances are the computer you might be reading this article on, or perhaps a system collecting dust in your closet is resourceful enough to run Avalanche.

The mechanism for reward scaling for validator nodes hinges on the amount of time a node has staked its tokens, called proof of uptime. It also depends on proof of correctness, which measures if the node is known to act according to the software’s rules.

source: docs.avax.network

source: docs.avax.network

Avalanche delegates its various tasks among three different built-in chains in order to engender the golden trinity of blockchain essentials — scalability, security, and decentralization. The secret sauce that makes this distribution work is the fact that digital assets can be moved across each of these chains to accomplish different functions within the ecosystem.

- The Exchange Chain (X-Chain): It is the default blockchain and is responsible for creating and transacting assets. Avalanche’s native token, AVAX is the most used cryptocurrency on the platform, followed by JDG and PNG. The transactions carried on the X-Chain generate fees which are paid in AVAX. That’s similar to how gas fees on Ethereum are paid in ETH. The X-Chain is an instance of the Avalanche Virtual Machine (AVM).

- The Contract Chain (C-Chain): It allows for the creation and execution of smart contracts and decentralized apps (dApps). Being fully compatible with Ethereum Virtual Machines (EVM), Avalanche’s smart contracts can take advantage of cross-chain interoperability. Deploying existing Defi applications like Aave is a piece of cake!

- The Platform Chain (P-Chain): It coordinates the validators and allows the creation of new chains. Analogous to the scaling solutions of other popular networks like Polkadot’s parachains and Ethereum 2.0’s shards, Avalanche allows its users to develop specialized chains that can operate using their own sets of rules. These chains achieve consensus through subnets. Subnets are groups of nodes that participate in validating a designated set of blockchains. The validator nodes of each subnet must also participate in the validation process of the primary Avalanche network.

The Avalanche network is fueled by its native token Avalanche (AVAX) and multiple consensus mechanisms. These coins are staked by the validators which earn them rewards for locking them up for a definite period, while also providing the benefit of a more secure network. At present, about 220 million AVAX tokens are in, and a maximum supply of the tokens is capped at 720 million. The genesis block of the network accounts for 360 million AVAX tokens, and the rest of the 360 million tokens are expected to be minted and fully vested by July 2030. Currently, ~64% of the tokens in supply are staked.

Unlike other PoS-based platforms, Avalanche does not condone slashing, if the node is malicious, it will not receive any rewards, but the stake is never at risk. The Avalanche network also presents its users with its in-house wallet solution offering secure, non-custodial storage for Avalanche assets.

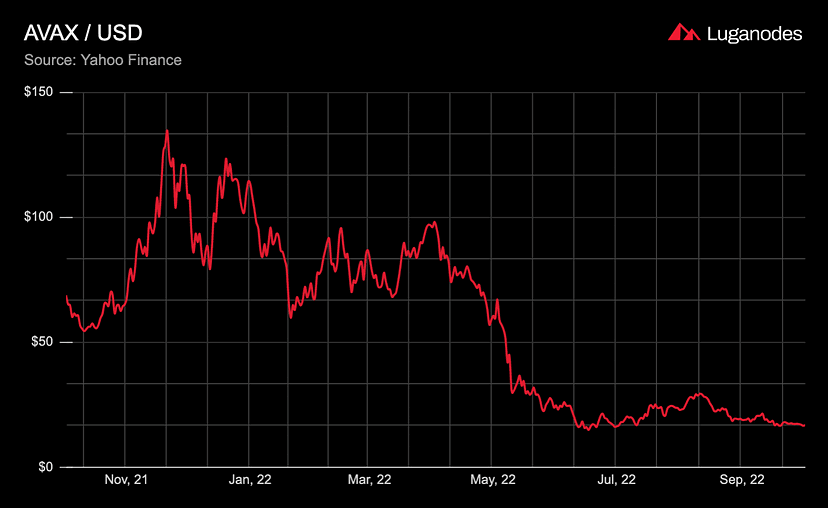

The value of the AVAX token achieved an all-time high of 148 USD in November 2021. Since then it has plummeted by about 89%.

This trend is accounted for by two factors:

- People selling altcoins in favor of BTC

- Federal reserve interest rate hikes to correct post-pandemic inflation.

Higher interest rates correspond to a lower appetite for high-risk/high-return assets such as cryptocurrencies. Since the long-anticipated interest rate hikes (from about December 2021), began in March 2022, the broader crypto market has been in a correction, and Avalanche’s AVAX is no exception. AVAX also dropped in value after facing backlash over a whistleblower report published in July 2022.

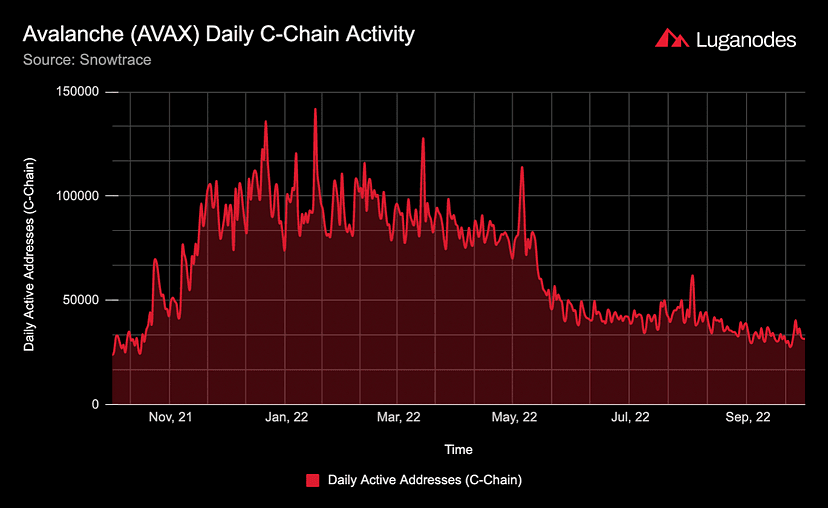

Consequently, the number of daily active addresses was also impacted, with the investor sentiment relegating address activity to an average of ~39,000 per day in Q3, from an average of ~63,000 per day in Q2. While Q3 trends have not shifted as dramatically as those of Q2, the daily active addresses still experienced a decline from a stable 42,000 per day in June 2022. It is important to notice that, despite the market pressure, this network activity is still considerably greater than it was just a year ago. The number of daily active addresses peaked in Q1 with a whopping 140,000 per day.

Consequently, the number of daily active addresses was also impacted, with the investor sentiment relegating address activity to an average of ~39,000 per day in Q3, from an average of ~63,000 per day in Q2. While Q3 trends have not shifted as dramatically as those of Q2, the daily active addresses still experienced a decline from a stable 42,000 per day in June 2022. It is important to notice that, despite the market pressure, this network activity is still considerably greater than it was just a year ago. The number of daily active addresses peaked in Q1 with a whopping 140,000 per day.

In essence, Avalanche is a promising addition to the family of layer-1 blockchains which can handle smart contracts and as efficiently as it handles transactions. This highly scalable, secure, and interoperable system simplifies the process of launching enterprise blockchains and decentralized apps.

In essence, Avalanche is a promising addition to the family of layer-1 blockchains which can handle smart contracts and as efficiently as it handles transactions. This highly scalable, secure, and interoperable system simplifies the process of launching enterprise blockchains and decentralized apps.

If you hold the AVAX token, you can enhance your portfolio by staking to earn rewards. Leverage Luganodes' institutional-grade infrastructure to stake your holdings and create a passive income. Staking with us ensures ease of use, support, and safety while you earn, and also contribute to the security of the Avalanche chain.

Learn how to stake AVAX tokens using this guide. You can learn more about staking on our website, and feel free to contact us for any queries!

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

Suite #4-210, Governors Square, 23 Lime Tree Bay Avenue,

PO Box 32311, Grand Cayman KY1-1209, Cayman Islands